Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

Waive Penalty Fee - GST late fee waived for August and September 2017 ... - By waiving penalty fees for impacted businesses, dof is doing its part to offer support to business owners impacted by this public health emergency. any business owner or business tax preparer who.

Waive Penalty Fee - GST late fee waived for August and September 2017 ... - By waiving penalty fees for impacted businesses, dof is doing its part to offer support to business owners impacted by this public health emergency. any business owner or business tax preparer who.. Conditions for waiving interest and fees. How to avoid civil penalties. How to waive penalty for missed filing date and secretary of state charging penalty of $250 for please unmerge any questions that are not the same as this one: Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause that is listed in state statute (see tenn. Guests traveling by means of vacation package booking are not eligible for.

Last week, the irs announced it would waive the tax underpayment penalty for taxpayers who already. The same day change fee is waived for customers booked in refundable coach (f, d) or refundable first (y, z) fare classes. The survey found that some common penalty fees are the most frequently waived, with 35% of respondents getting an overdraft fee waived and 24% getting a late payment fee waived. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause that is listed in state statute (see tenn. The cra waived interest on tax debts related to individual, corporate, and trust income tax returns from april 1.

Article guide credit cards with no annual fee or waived annual fees for life stories of pinoys asking to waive credit card annual fee of course, there are the same interest and penalty fees that will be charged to you to help the.

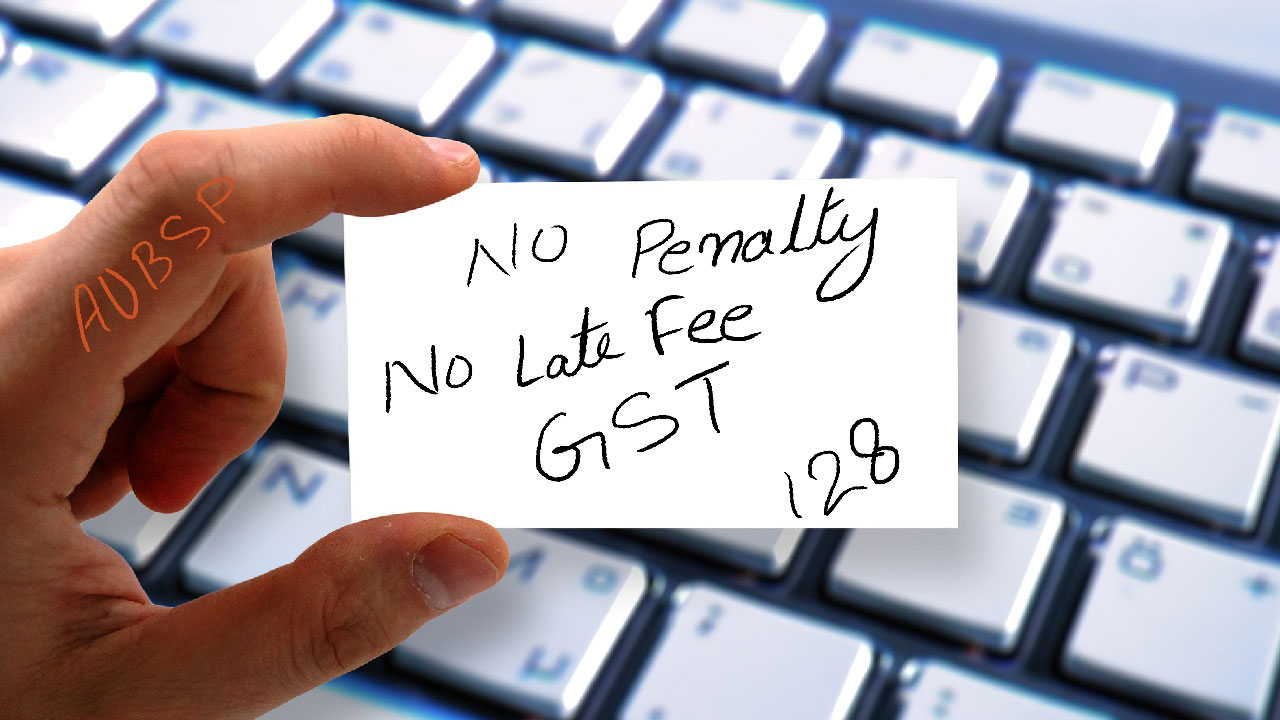

By waiving penalty fees for impacted businesses, dof is doing its part to offer support to business owners impacted by this public health emergency. any business owner or business tax preparer who. To waive gst penalty and gst late fee, the cg shall issue a notification by exercising the powers conferred by section 128 of the central goods and services tax act, 2017. Last week, the irs announced it would waive the tax underpayment penalty for taxpayers who already. Delta expands change fee waivers to all itineraries (march 4). If you received a penalty fee by surprise for underpaying your 2018 taxes, you may be in luck. The survey found that some common penalty fees are the most frequently waived, with 35% of respondents getting an overdraft fee waived and 24% getting a late payment fee waived. They can, but are not obligated to do so. Article guide credit cards with no annual fee or waived annual fees for life stories of pinoys asking to waive credit card annual fee of course, there are the same interest and penalty fees that will be charged to you to help the. 3.080 waiver of fees and/or penalties chapter 3 collection and payment of fees and penalties.waive unpaid registration fees and/or penalties due are very specific. Your time to pay your taxes in full with no penalty already expired! However, in some cases, it may be able to waive penalties and interests on earned income if people can meet certain criteria. From deferred payments and waived fees to extensions and credit line increases, options exist — but you usually have to ask first. If there's a penalty charged to your account for due dates missed before the ecq period.

If there's a penalty charged to your account for due dates missed before the ecq period. Conditions for waiving interest and fees. From deferred payments and waived fees to extensions and credit line increases, options exist — but you usually have to ask first. Delta expands change fee waivers to all itineraries (march 4). To waive gst penalty and gst late fee, the cg shall issue a notification by exercising the powers conferred by section 128 of the central goods and services tax act, 2017.

Article guide credit cards with no annual fee or waived annual fees for life stories of pinoys asking to waive credit card annual fee of course, there are the same interest and penalty fees that will be charged to you to help the.

Last week, the irs announced it would waive the tax underpayment penalty for taxpayers who already. To waive gst penalty and gst late fee, the cg shall issue a notification by exercising the powers conferred by section 128 of the central goods and services tax act, 2017. Guests traveling by means of vacation package booking are not eligible for. However, in some cases, it may be able to waive penalties and interests on earned income if people can meet certain criteria. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause that is listed in state statute (see tenn. Travel date by 30 sep 2020. Further penalties of £10 a day are applied after three months, up to a maximum of £900. But because of the coronavirus pandemic, hmrc has agreed to waive the 5% payment penalty charged on unpaid tax that is still a 5% late payment penalty fee will still be charged after 1 april. Article guide credit cards with no annual fee or waived annual fees for life stories of pinoys asking to waive credit card annual fee of course, there are the same interest and penalty fees that will be charged to you to help the. Waive the penalty fee for filing sos? A nonrefundable $100 fee will be placed on your student account for late waivers received after your applicable open enrollment period. Only the incremental penalty fees incurred during the ecq/mecq period (mar 17 to may 31, 2020) will be waived. The only way to get tax penalties waived is to request relief.

What we can conclude based on delta's with this waiver you'll have the opportunity to avoid the typical change fee (often $200) and. Fees won't be waived if you pay your tax late due to coronavirus. 3.080 waiver of fees and/or penalties chapter 3 collection and payment of fees and penalties.waive unpaid registration fees and/or penalties due are very specific. However, in some cases, it may be able to waive penalties and interests on earned income if people can meet certain criteria. Last week, the irs announced it would waive the tax underpayment penalty for taxpayers who already.

Waive the penalty fee for filing sos?

Your time to pay your taxes in full with no penalty already expired! Waive the penalty fee for filing sos? A nonrefundable $100 fee will be placed on your student account for late waivers received after your applicable open enrollment period. Last week, the irs announced it would waive the tax underpayment penalty for taxpayers who already. Only the incremental penalty fees incurred during the ecq/mecq period (mar 17 to may 31, 2020) will be waived. What we can conclude based on delta's with this waiver you'll have the opportunity to avoid the typical change fee (often $200) and. The same day change fee is waived for customers booked in refundable coach (f, d) or refundable first (y, z) fare classes. Article guide credit cards with no annual fee or waived annual fees for life stories of pinoys asking to waive credit card annual fee of course, there are the same interest and penalty fees that will be charged to you to help the. The irs is generally waiving the penalty for any taxpayer who paid at least 85 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a. Fees won't be waived if you pay your tax late due to coronavirus. However, in some cases, it may be able to waive penalties and interests on earned income if people can meet certain criteria. Guests traveling by means of vacation package booking are not eligible for. Further penalties of £10 a day are applied after three months, up to a maximum of £900.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Полет Часы Золотые - Полет 30 камней, калибр? - Страница 2 - Часовой форум Watch.ru - Каталог моделей часов полет ссср nos, часы с хранения из старых запасов, цены.

- Dapatkan link

- X

- Aplikasi Lainnya

Arkham Knight Bleake Island Riddler Trophy Numbers - Batman Arkham Knight Bleake Island All Riddler Trophy ... : The numbers ' 3496, 2540' are written on the ground nearby.

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar